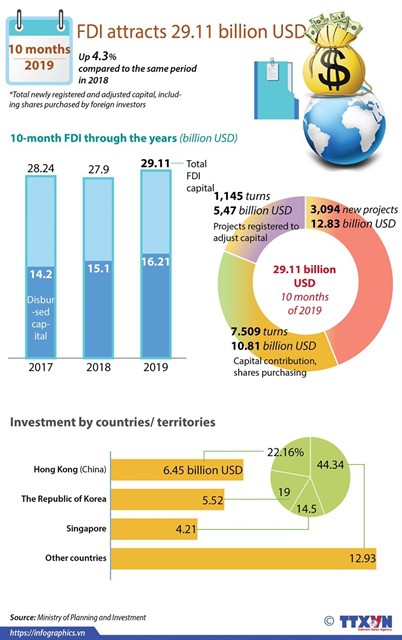

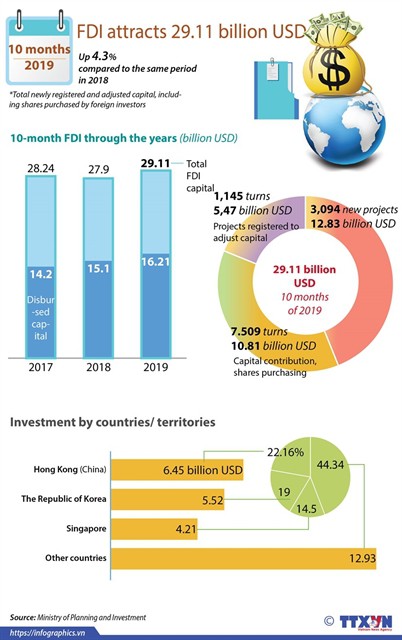

Vietnam attracted US$29.11 billion in foreign direct investment (FDI) in the first ten months of 2019, up 4.3 per cent over the same period last year, the Ministry of Planning and Investment's Foreign Investment Agency said on October 28.

|

| A graphic shows Vietnam's FDI attraction in the first ten months of 2019. |

Vietnam attracted US$29.11 billion in foreign direct investment (FDI) in the first ten months of 2019, up 4.3 per cent over the same period last year, the Ministry of Planning and Investment’s Foreign Investment Agency said on October 28.

FDI disbursement also saw a year-on-year increase of 7.4 per cent to an estimated $16.21 billion during the period, the agency said.

From January to October, the country licensed 3,094 new projects with total registered capital of $12.83 billion, up 26 per cent in the number of projects but down 15 per cent in the level of capital.

The agency attributed the drop in new registered capital to the smaller scale of projects, with the biggest one this year worth $420 million in comparison to the same period last year that saw large-scale projects including a Japanese smart city, valued at $4.14 billion, and a Republic of Korea-invested polypropylene manufacturing plant and liquefied petroleum gas warehouse, worth $1.2 billion.

Up to 1,145 existing projects were allowed to raise their capital by $5.47 billion in the first ten months of 2019, equivalent to 83.6 per cent of the value from a year ago.

According to the agency, foreign firms invested $10.81 billion in Vietnam during the period through capital contributions and share purchases, representing a year-on-year increase of 70.5 per cent and accounting for 37.1 per cent of the total registered capital.

Processing and manufacturing remained the most attractive sector to foreign investors, drawing $18.83 billion, making up 68.1 per cent of the total FDI pledges. Real estate came next with $2.98 billion (10.2 per cent of the total), followed by wholesale and retail and science and technology.

Among the total 107 countries and territories investing in the country, Hong Kong was the largest investor with $6.45 billion, followed by the Republic of Korea (RoK) with $5.52 billion and Singapore with $4.21 billion.

The capital city retained its position as the largest FDI recipient during the period with $6.61 billion, accounting for 22.7 per cent of the total. HCM City ranked second with $4.96 billion or 17 per cent, followed by the southern provinces of Binh Duong and Dong Nai and the northern province of Bac Ninh.

Exports by the foreign-invested sector (including crude oil) in the first ten months were worth $150.4 billion, up 3.9 per cent year-on-year. Exports excluding crude oil stood at $148.7 billion, up 4.1 per cent.

Imports by the FDI sector were $122.1 billion, up 4.4 per cent against the same period of 2018. The FDI sector therefore recorded a trade surplus in the first ten months of $28.3 billion including crude oil and $26.6 billion excluding crude oil.

Overseas investment

Vietnamese enterprises invested nearly $412 million in foreign markets in the first ten months of 2019, the agency also announced the same day.

Of the investments, $312 million was poured into 128 new projects while the remaining $100 million was pledged to 28 existing projects.

Their outbound investment mainly focused on the wholesale and retail sector at $111 million, accounting for 27 per cent of the total.

The agro-forestry-fisheries sector took second place with total investment of $66 million, making up 16 per cent, followed by science and technology at $59.4 million, accounting for 15 per cent of the total.

Vietnamese firms invested into 30 countries and territories in the period. Australia lured the biggest amount of investment with $141 million, accounting for 34 per cent of the total.

The US came next with $62 million or equivalent to 15 per cent, followed by Spain, Cambodia, Singapore and Canada.

(Source: VNS)