From July 1, 2025, a series of tax policies have come into effect, covering value-added tax (VAT); tax administration in e-commerce, household businesses and individuals; and e-invoices,... After more than a month in force, taxpayers have actively sought information, adapted, and complied with the new tax policies.

|

| Taxpayers apply for tax procedures at the Dong Nai provincial Tax Department |

Policies such as the 2024 VAT Law; regulations on using personal identification numbers instead of tax codes; tax management in e-commerce, and reduced VAT rates… have been studied and applied by taxpayers in accordance with regulations, particularly for cases of household businesses and individuals issuing e-invoices generated from cash registers that are electronically connected to tax authorities, tax declaration on e-commerce platforms...

Updates on tax policies

From July 1, 2025, the regulation stipulating that personal identification numbers issued under the 2023 Law on Identity Cards will be used in place of tax codes for Vietnamese citizens, as stipulated in the National Assembly’s Law on Tax Administration No. 38/2019/QH14 and the Ministry of Finance’s Circular No. 86/2024/TT-BTC dated December 23, 2024, on tax registration, has officially taken effect. Accordingly, the personal identification number of the head of a household, the head of a household business, or an individual business owner will replace the tax code for that household, household business, or individual business.

To implement e-identification regulations via the VNeID application for businesses, many business owners have updated their information in the system. Nguyen Thi Kieu Oanh (Director of G.T. Co., Ltd., Tan Trieu Ward) said she has complied with the new rules and guided some friends who also run businesses to register e-identification for their companies. She shared: “Recently, many tax regulations related to businesses have been issued and taken effect, showing that tax administration is being carried out seriously and more strictly. Therefore, when state agencies set requirements, businesses, especially small ones, should proactively comply. Under the regulations, once registered for e-identification, businesses can access electronic services and quickly obtain relevant information on the digital platform.”

Other regulations, such as using personal identification numbers instead of tax codes for Vietnamese citizens and new tax policies, have also drawn attention. Moreover, some provisions have attracted particular interest, such as applying e-invoices from cash registers connected to tax authorities.

Tran Thi Huong, owner of Mai Xuan grocery store (Tran Bien ward) shared: When she first heard that stores must use e-invoices from cash registers connected to tax authorities, she was very concerned because she had never used such technology. However, after researching and receiving support from a solutions provider, she gradually became familiar with the process and was able to issue invoices to customers. Still, she admitted to feeling confused when network connections failed or when she made errors during the implementation...

Supporting taxpayers in keeping up with policies

In recent times, recognizing both the advantages and challenges faced by taxpayers in implementing tax regulations, the tax authority has organized training and guidance for taxpayers ranging from household businesses to domestic and foreign-invested enterprises in Dong Nai.

According to the Dong Nai Tax Department, in order to support taxpayers in implementing tax policies, the sector has carried out key tasks and solutions to improve the business environment, enhance corporate competitiveness, and develop action plans to implement directives from the provincial People’s Committee and the General Department of Taxation. The provincial tax authority has instructed its units to decisively carry out administrative reform in taxation, always putting enterprises and taxpayers at the center and considering them as the driving force of reform. The sector consistently maintains strict control over administrative procedures to ensure the highest efficiency in resolving them...

Statistics from the Dong Nai Tax Department show that by June 30, 2025, more than 3,000 business establishments had registered to use e-invoices with tax authority codes generated from cash registers, reaching 106% of the target. These include over 1,800 enterprises and more than 1,200 household businesses.

Regarding communication to taxpayers, Provincial Tax Chief Nguyen Toan Thang said: The sector will continue to strengthen dissemination, taxpayer support, and e-invoice management. Accordingly, this includes promptly and effectively implementing measures on tax, fee, and land rent extensions, exemptions, and reductions to support businesses and citizens. Efforts will focus on strengthening communication at all levels, in all departments, and across all areas, with diverse methods. The tax authority will promptly post new content of tax policies and tax administrative procedures so that taxpayers can stay updated.

|

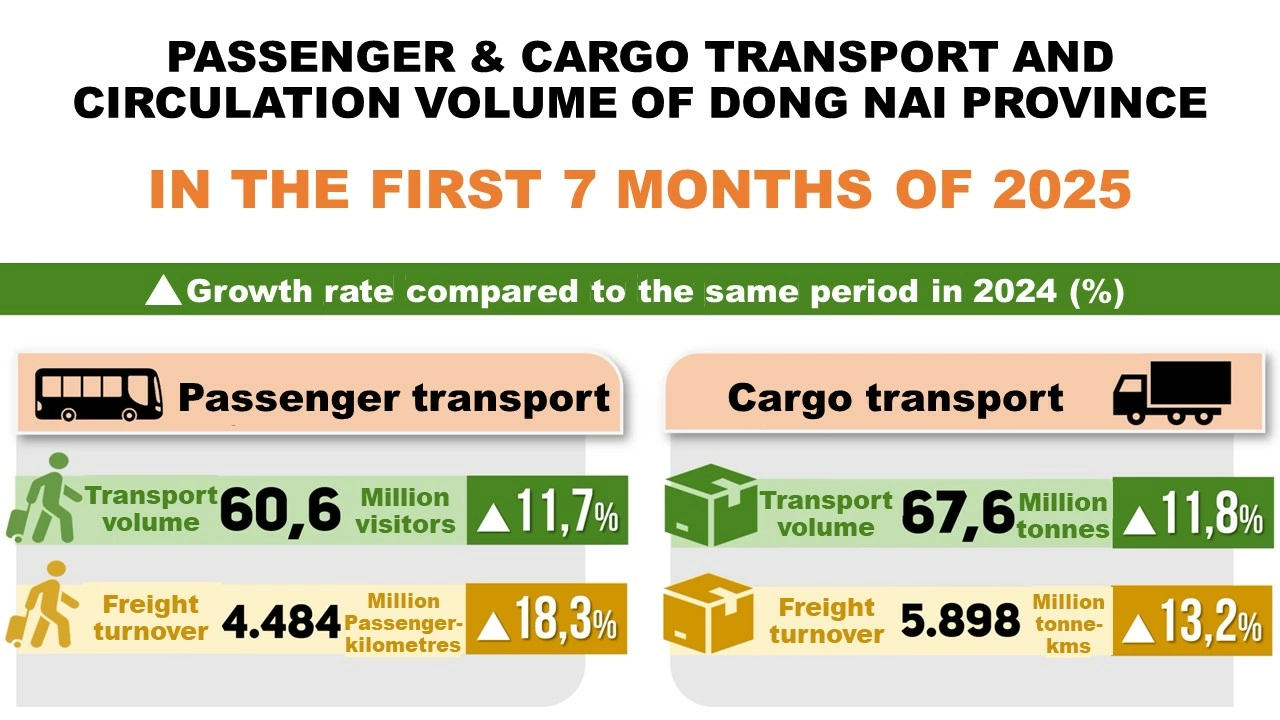

| Graphic showing the volume of passenger and cargo transport and circulation in Dong Nai Province over the first seven months of 2025, based on data from Dong Nai Statistics. |

To increase interaction with taxpayers, the tax sector will organize dialogue conferences to address and resolve difficulties and obstacles related to tax policies and administrative procedures. During the implementation of tax policies, the authority will regularly review, propagandize, encourage, and require businesses and household businesses subject to the application of e-invoices generated from cash registers, especially in sectors with direct retail to consumers as directed by the Government and Prime Minister, such as restaurants, hotels, catering services, transportation, fuel, shopping centers, entertainment services, beauty services, and retail pharmaceutical sales...

By Ngoc Lien

Translated by Minh Hanh - Thu Ha

Thông tin bạn đọc

Đóng Lưu thông tin